Gold, Tech, and a Rate Cut: 5 Trends You Shouldn’t Miss Today

From AI stocks to gold miners, here's what the Fed’s pivot just opened up—and what’s still underpriced.

The Fed just cut interest rates for the first time this year—by 25 basis points—and signaled more cuts could come. Stocks are rallying, but under the surface, this rate pivot could reshape the opportunity map.

Inflation is still at 2.9%. The labor market is softening. The dollar is holding up—for now. And yet, the S&P 500 just hit new highs. Intel surged 22% after Nvidia dropped a $5 billion vote of confidence into its future.

This Gold Miner's Next Move Could Be a Game-Changer

A small-cap Nevada gold miner is already producing and has expansion in sight-backed by an onsite refinery and a $6 billion gold asset it's just starting to tap.

But that's not all.

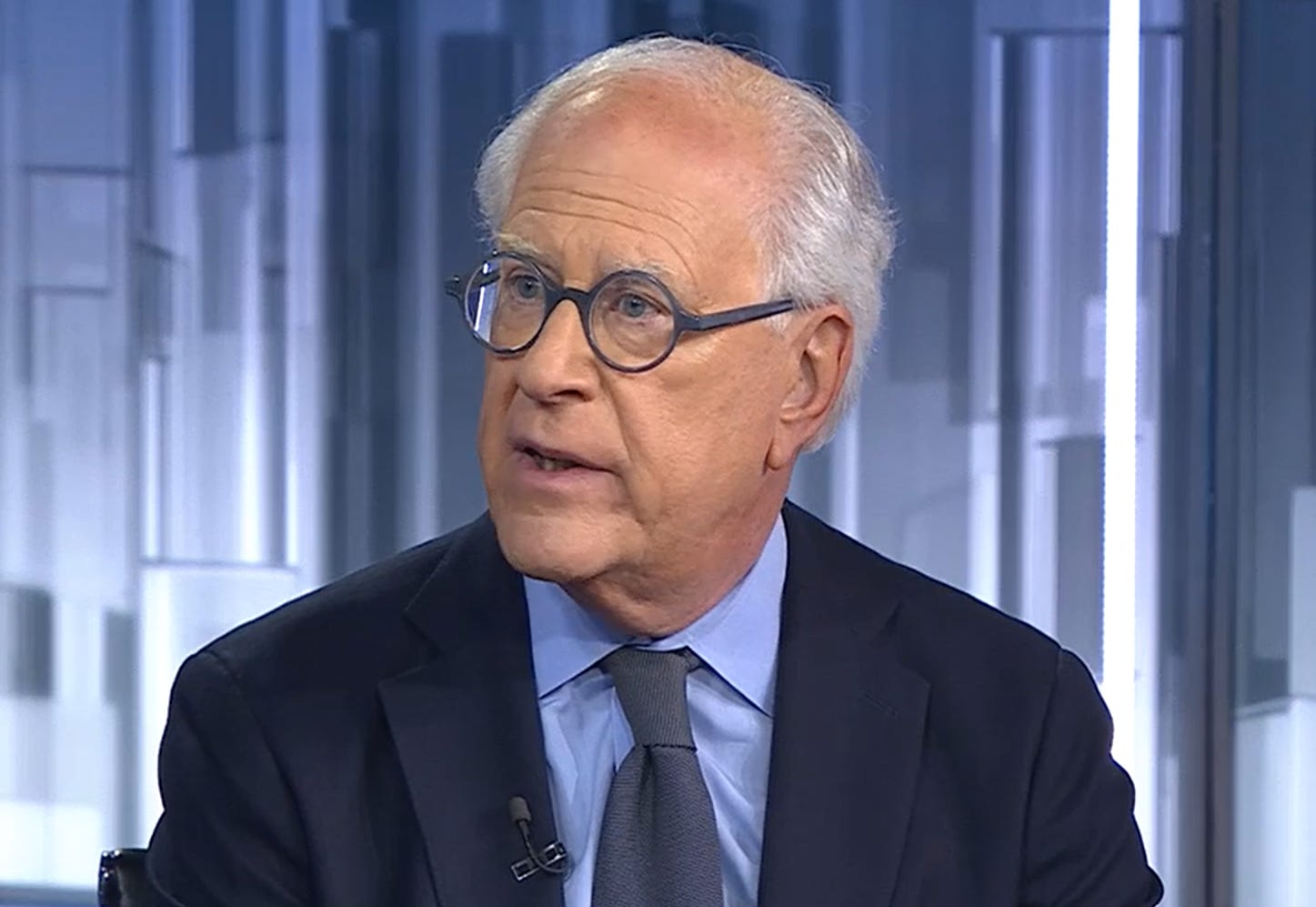

One of gold's most legendary investors recently doubled his stake in the company.

He's not alone.

And if the expansion hits, this could be the moment retail investors wish they had watched more closely.

Find out what's behind the growing buzz.

Here’s what’s starting to line up:

Opportunities Today

Gold Breaking Out of the Fog: The Fed is easing into inflation. That’s quietly bullish for gold, which thrives when real yields fall. Gold miners, especially mid-caps with low-cost extraction, haven’t caught up to the macro shift yet.

AI Infrastructure Expansion: Nvidia’s investment in Intel shows AI isn’t just about GPUs—it’s about capacity, fabs, and scalability. That opens the door to legacy chipmakers, equipment suppliers, and niche AI infrastructure plays.

The Return of Growth Trades: Lower rates reduce discount pressure on growth sectors. Cloud, software, and unprofitable tech might regain momentum if the macro holds. Watch for rotation into mid-tier growth names.

Rate-Driven Repricing in Bonds & Credit: Short-term yields may drop first. That makes room for tactical bond trades—especially in floating rate or duration-sensitive ETFs.

Energy and Materials as Quiet Gainers: Oil’s down today, but long-term supply-demand remains tight. A broader commodity recovery could follow if inflation picks up again and real rates slide.

Watchlist Themes Today: Mid-cap gold producers, semiconductor supply chains, small-cap tech, floating-rate bonds, and oversold energy equities.

BULLISH: It's time to buy this 'hidden' AI stock

An award-winning stock-rating system has turned BULLISH on some of the biggest winners of 2025. Here's what it's saying now.